EG is proud to share our latest Global Real Estate Sustainability Benchmark (GRESB) results across our Australian Core Enhanced (ACE) and Delta ESG Property Funds — reflecting our ongoing commitment to sustainability and continuous improvement through active asset management.

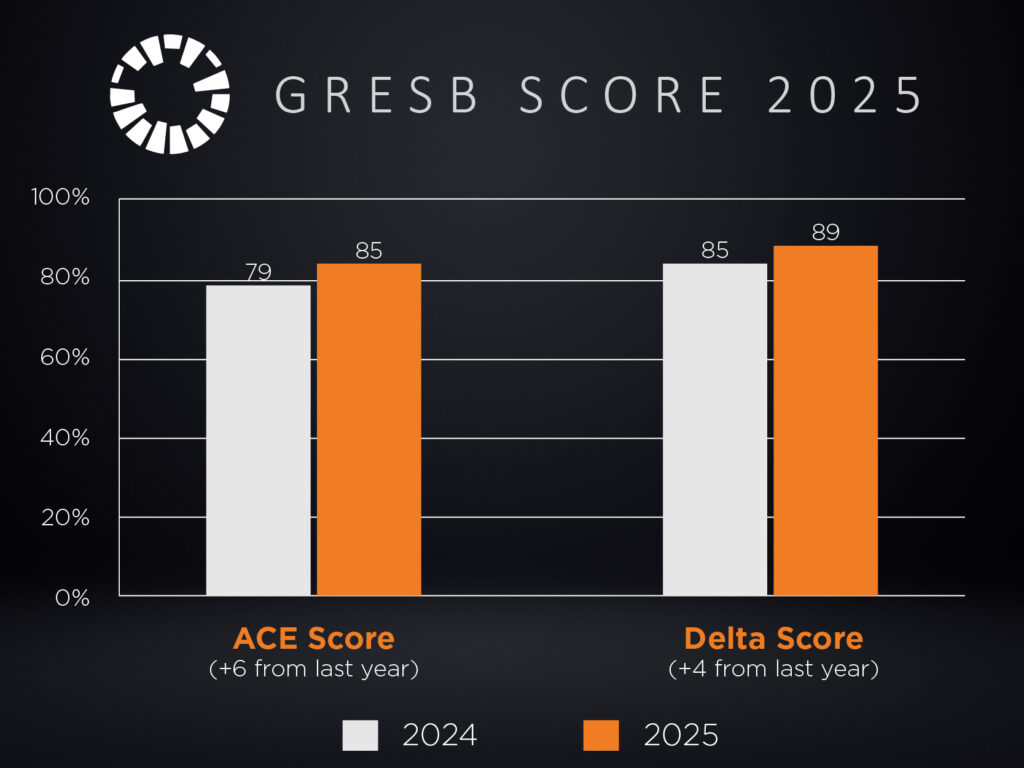

In the 2025 assessment, the ACE Fund achieved its highest-ever score, marking a significant milestone in EG’s sustainability performance. The ACE Fund recorded a score of 85, up six points from last year, while the Delta Fund rose by four points to 89. The improvement was driven by continued investment in energy and water efficiency projects, which reduced the environmental footprint of our assets. Better environmental data management, supported by our property managers, also helped lift this year’s results.

GRESB is an independent global assessment that measures the environmental, social and governance (ESG) performance of real estate and infrastructure portfolios. It benchmarks participating companies and funds across more than 70 countries, providing a trusted framework for comparing and improving sustainability outcomes within the industry.

EG Funds has proudly taken part in the GRESB assessment for the past seven years, using it as a key tool to evaluate our progress and identify opportunities to raise the bar even higher each year. Our continued participation reflects our commitment to transparency and accountability in how we manage our assets and deliver value for investors, tenants, and communities alike.

The consistent year-on-year improvements highlight not only the strength of EG’s ESG programs, but also the dedication of our people — from investment and development teams to asset and facilities managers — all working together to drive meaningful, measurable impact across our portfolio.

“We’re proud of the progress reflected in this year’s results, which recognise the practical steps we’re taking to decarbonise our portfolio and strengthen our social impact,” said Samual Robbie, Fund Manager for ACE. “By focusing on practical initiatives that reduce emissions, improve efficiency and create social value, we’re building real momentum towards a more sustainable portfolio.”

Looking ahead, EG will continue collaborating with partners such as Avani and Little BIG to deliver lasting impact through initiatives that promote decarbonisation and social connection across our assets.