Reducing risks and optimising returns

EG’s PRISMS® is a data driven investment platform for identifying, pricing and managing commercial real estate risk.

EG’s disciplined, data-driven approach to risk management with property technology has enabled us to safeguard investor funds whilst maximising returns.

The benefits

- Standardised way to identify and dissect risk

- Reduces the tendency towards human bias

- Identifies unseen investment opportunities

- Examines all assumptions collectively

- Individual asset assessments based on strategy

- Ease of gathering information for reporting purposes

The modules

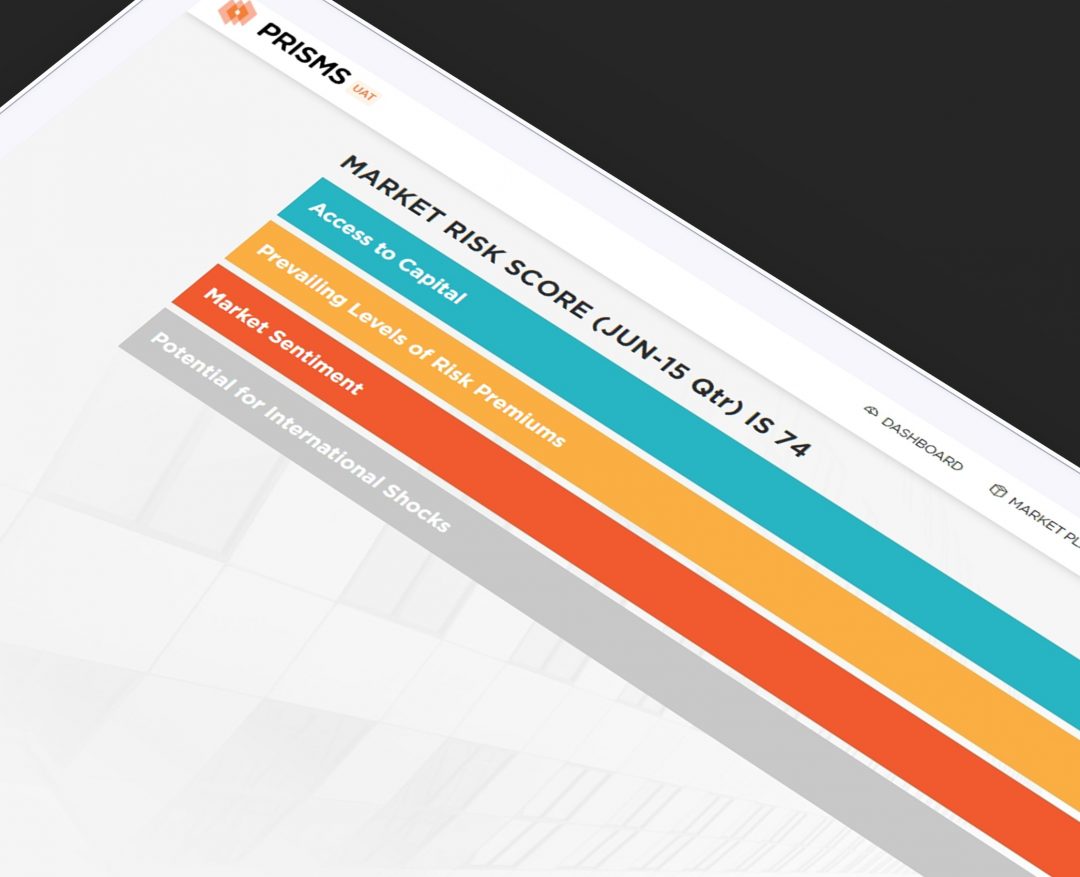

Combining big-data and industry knowledge from the EG management team, PRISMS® market risk assessment takes a quarterly ‘pulse-check’ of the key quantitative and qualitative analysis that affect: (i) ease of access to capital; (ii) prevailing levels of risk premiums; (iii) market sentiment; and (iv) the potential for international shocks. The corresponding score measures the vulnerability of the market to a correction.

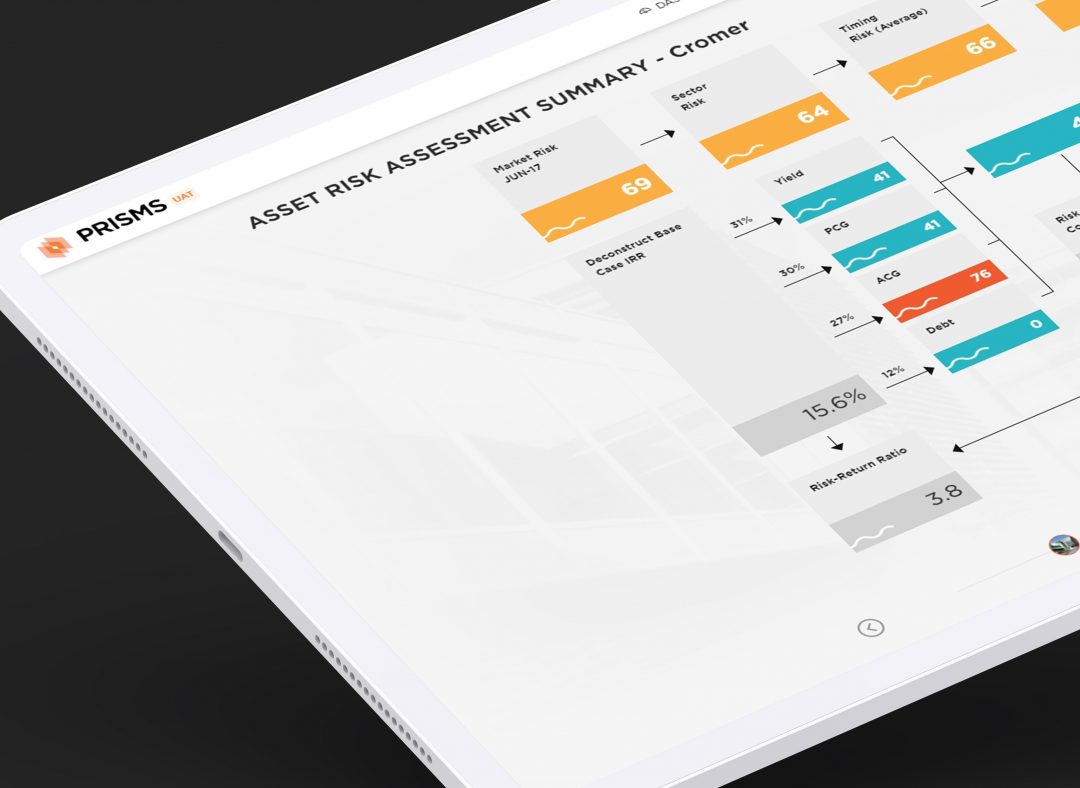

PRISMS® enables EG to identify and manage the risks involved when acquiring an asset. Each assessment is tailored to the asset’s specific sector, whether there is rezoning involved, and the corresponding EG value-add strategy. EG requires that all assets be assessed through PRISMS® to ensure all risks are identified and priced on acquisition and appropriately managed post-acquisition.

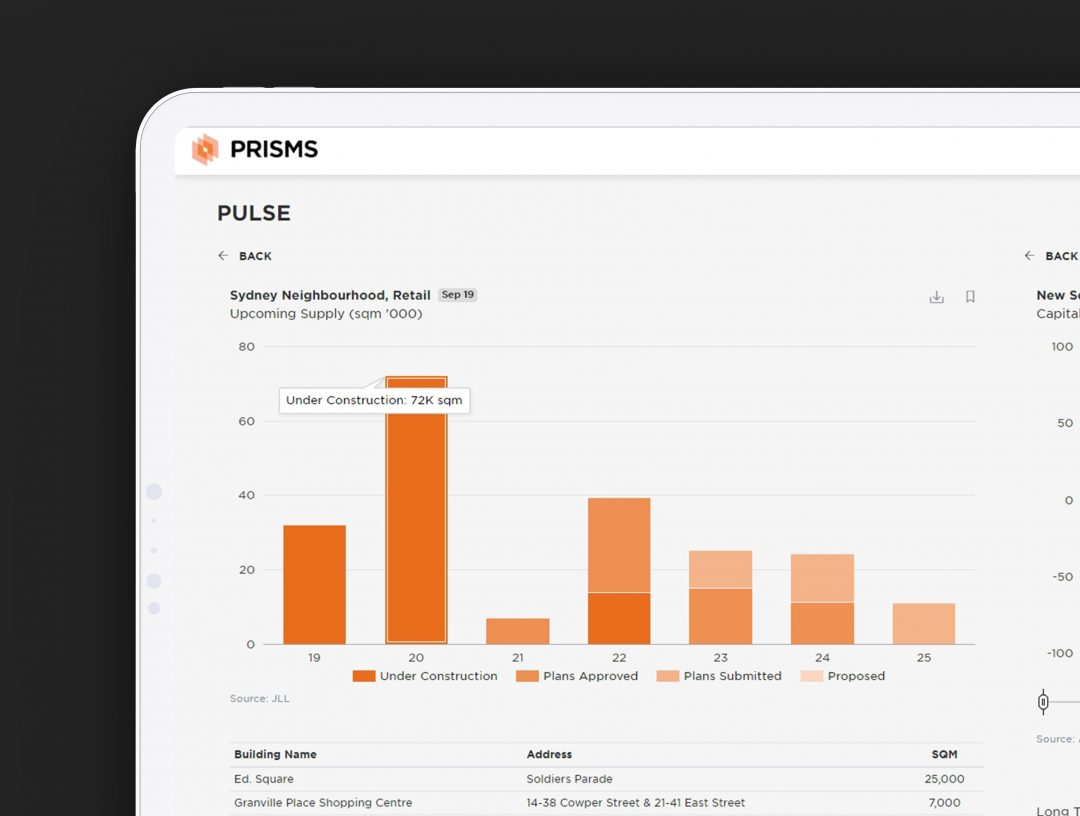

EG’s Pulse module enables the team to aggregate and compare big data in a timely manner, necessary for big decision making and performance monitoring.