Private debt, also known as private credit, is gaining popularity as a mainstream investment among Australians.

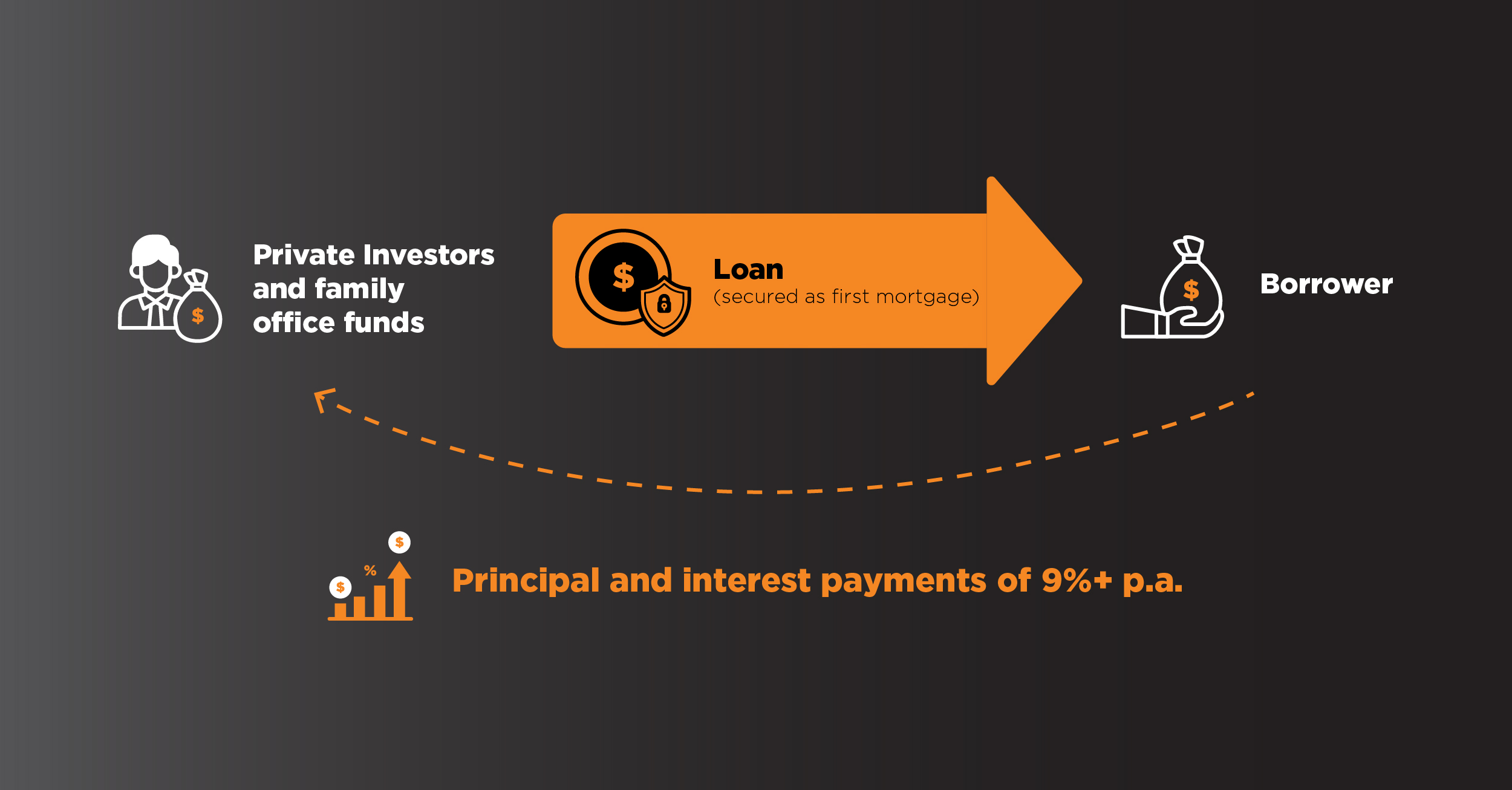

The banks traditionally dominated the debt market, but regulatory pressures have resulted in them evolving and shifting their focus to larger borrowers. As a result, private investors and family offices are working with non-bank lenders to fill the gap. Investors are proactively funding non-bank lenders, offering loans to borrowers who are currently overlooked.

With the sector still within its embryotic stages, many potential investors are still asking ‘How does it actually work?’

Securing the right borrower

Non-bank lenders offer a range of capital products, including real estate bridging loans, which can be challenging to obtain from major banks.

EG partners with a non-bank lender, Msquared Capital, leveraging their existing network of mortgage brokers and quality borrowers.

Msquared Capital undertakes a thorough risk assessment to examine the borrower’s credit quality. The process consists of evaluating five broad categories: character, capacity, cash flow, competency, and collateral.

Meanwhile, EG assesses the prospective real estate to be purchased for any risks and the property’s potential if an unexpected loan default occurs.

Creating a balanced funding solution

Once EG and Msquared Capital are satisfied with the results of the assessment, the capital-raising process is initiated. Leveraging our network of private investors and family offices, we alert them to the investment opportunity.

Investors interested in the opportunity fund the loan, allowing syndication to create a mortgage that caters to the borrower’s needs and ensures solid returns for investors.

Risk and return

Healthy returns take place, with monthly distributions that include the principal and interest repayments.

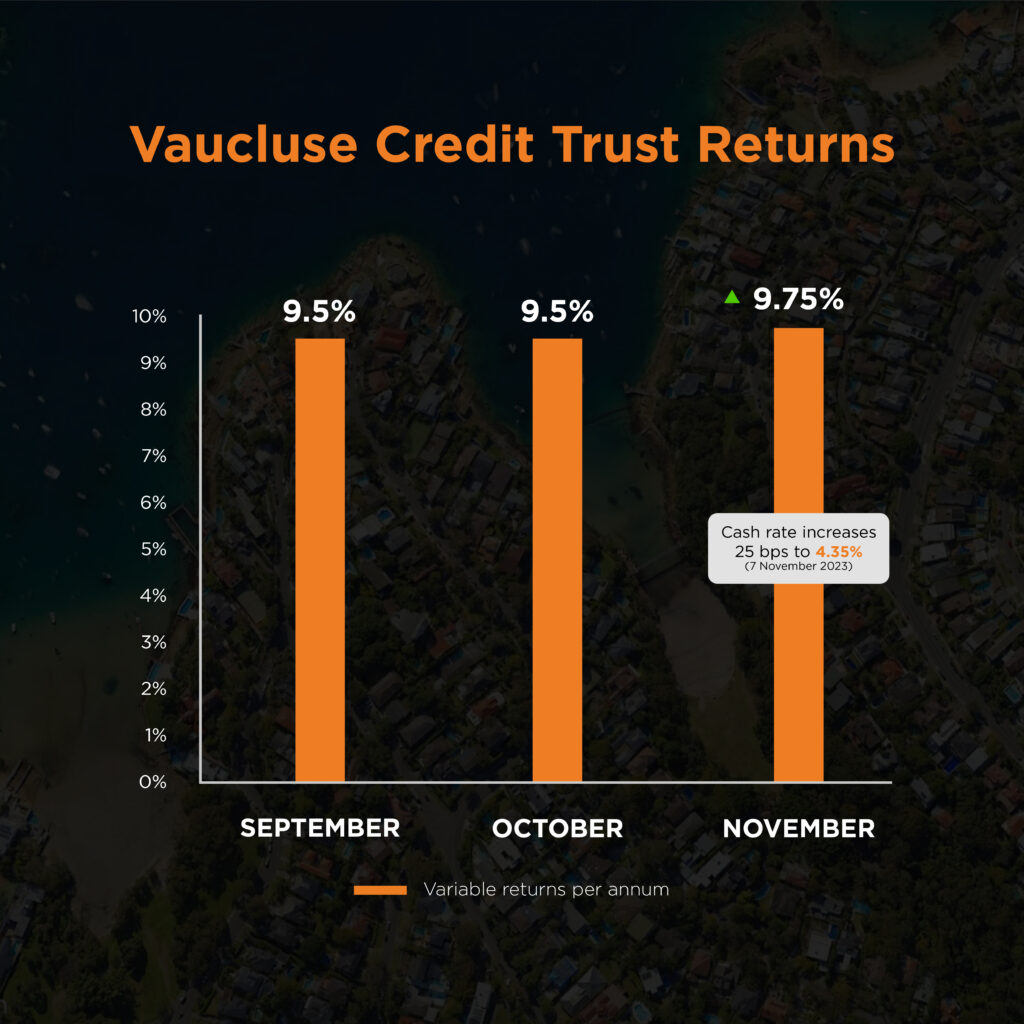

Returns are variable, influenced by the Reserve Banks of Australia’s (RBA) cash rate. As a result, investors experienced an increase to returns on the Vaucluse debt deal due to the RBA’s cash rate increase decision.

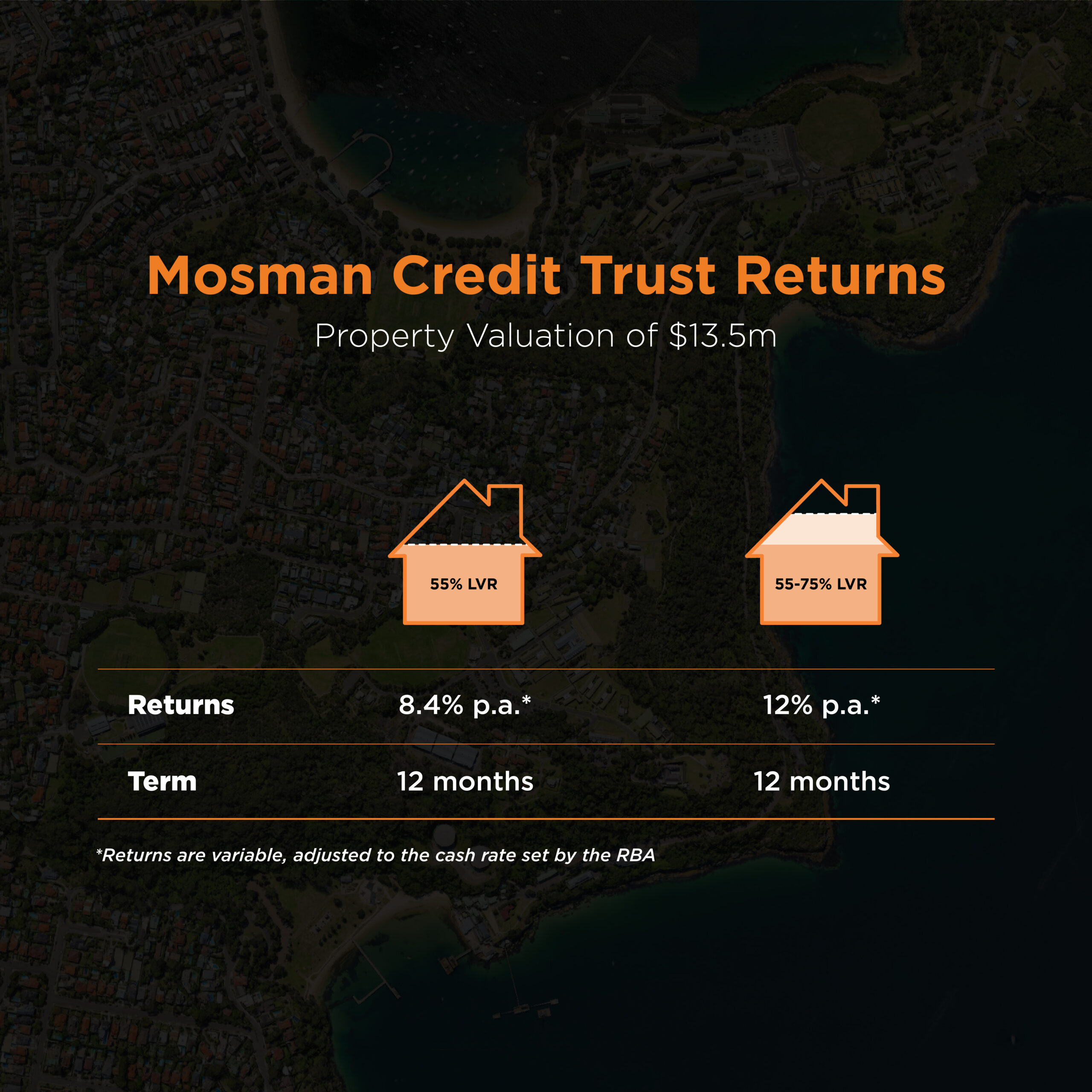

Returns are also influenced by the risk of the loan; higher risks translate to higher returns. A key risk driver is the loan-to-value ratio (LVR), which represents the percentage borrowed against the property’s value. Therefore, loans with an LVR of 75% would have a higher return than a 55% LVR.

To safeguard investors, loans are secured as a first mortgage. This means that if a borrower defaults on a loan, EG investors have the first rights to the property. That’s why EG’s real estate assessments are a crucial component of the process, with initial assessments providing an understanding of the property’s market potential if sold to recover funds.

The EG difference

Our point of difference is the equity experience to ensure a more rigorous assessment of opportunities than debt-exclusive counterparts. The same equity-underwriting structure can be applied to analysing debt opportunities, ensuring all asset and market-level risks are accurately priced into loans.

EG’s extensive experience of more than 20 years ensures optimal outcomes for investors.

Stay updated with EG’s Private Debt by signing up for our investment opportunities on our dedicated website here or reach out to Rodney Walt, Head of Private Wealth.