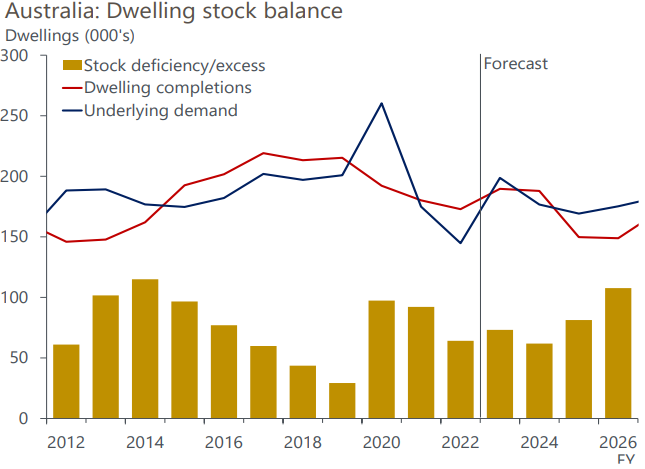

There has been a long history of housing stock deficiency in Australia.

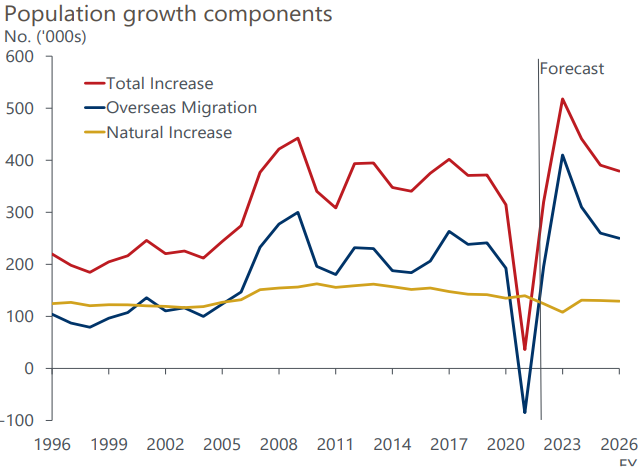

Total population growth forecasts remain elevated as migration skyrockets.

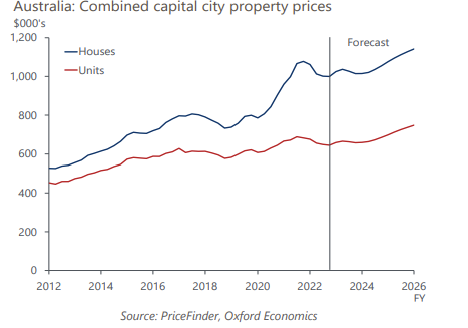

Despite being at the peak of the interest rate cycle, property unaffordability persists, and housing prices in numerous suburbs are increasing due to growing demand.

The key to addressing the crisis lies in increasing housing supply.

Project Feasibility

Traditionally, many medium to large-scale development projects take 3-6 years to obtain necessary approvals, then a further 8-12 months to obtain construction certificates. This is followed by off-plan marketing campaigns to get enough sales to meet financiers’ requirements even before the first shovel hits the ground. Not to mention, it also takes time for councils to consider re-zoning.

Over the past three years, construction costs skyrocketed by 30-40% due to inflation and labour shortages.

Many approved projects have been shelved as developers wait for property prices to increase enough to compensate for construction costs, holding costs and greater demand for purchasers to buy off-the-plan.

Builders operating within the residential sector, who are locked into fixed-price contracts, have dealt with construction costs, La Niña (a climate pattern leading to greater rainfall), supply chain issues, rising interest costs, labour shortages, as well as COVID-19 lockdowns and disruptions, whilst on thin margins.

Unsurprisingly, ASIC data shows 1031 construction companies falling to the liquidator’s knife – more than any time experienced over the past decade.

The construction industry has experienced a once-in-a-lifetime perfect storm, impacting the housing supply.

What is the reality that we face?

In short, the housing crisis is here to stay for several years. Market forces will result in property prices remaining elevated, and, over time, property will attract capital once the perceived market risk normalises. We should then see the necessary supply to meet demand.

That’s why EG is focused on luxury private debt deals to reduce risks for our investors.

To read the full article, please click here

Paul Miron, Managing Director at Msquared Capital, authored the original insight.

In May 2023, EG announced a joint venture with Msqaured Capital to offer Private Debt investment opportunities.