Recently, Tom Parker, executive vice president and publisher of Institutional Real Estate, Inc. spoke with Simon Fonteyn, executive director of FLNT, and Kooshan Mirzay Fashami, analytics lead for FLNT, a market place for actionable commercial real estate intelligence supported by EG’s technology incubator, EGX. Following is an excerpt of that conversation.

Could you introduce yourselves, describe your roles and relationship with EG?

Simon Fonteyn: I am the executive director of FLNT, which is a data-to-decision platform designed for commercial real estate investors to visualise, analyse and search millions of data points at speed. In 2021, FLNT became one of four technology start-ups that were backed by EG’s technology incubator, EGX. With the backing of EG through EGX, FLNT is now developing a leading data lake with access to more than 50 data sources, four of which are proprietary — including Australia’s largest online retail real estate dataset that I began collecting through the Leaseinfo Group 17 years ago.

Kooshan Mirzay Fashami: I work as the analytics lead at FLNT, managing the way we ingest data in a systematic way. We deal with a large volume of data — hundreds of millions of data points — that we synthesise and map in one place. We aim to make it easy for the users to create their own data dashboards. We are also working on using machine learning to make sense of the huge volume of data, to help the users make better investment decisions.

Big data has played a role in real estate for several decades now. How has the emergence of big data and the role it plays changed in the past five years?

Fonteyn: For the past five years in the commercial real estate industry, big data has been more of an operational support tool, rather than being used for investment. In the office market, for example, big data is being applied operationally through digital twins and building-management systems to improve automation and efficiency. In Australia’s retail shopping-centre space, the use of credit-card data and positional data, such as wi-fi intercepts and data from cell towers, are used by real estate investment companies to drive decisions around customer tracking, catchment areas and operational decisions about tenant mix.

Fashami: In the next three years, there will be more data produced than in the past 20 years combined, which highlights the exponential growth of data. The new stream of data provides new insights that were not available five to 10 years ago. For instance, analysing search queries online can tell us what the people in Australia — or in a specific suburb — are looking for online. What are the gaps in that local market? This data then can be used in combination with demographics and mobile data to triangulate where there is unmet demand for a certain product (e.g. dark chocolate) and how the tenancy mix can be optimised to address those needs.

How will the role of big data change, looking forward?

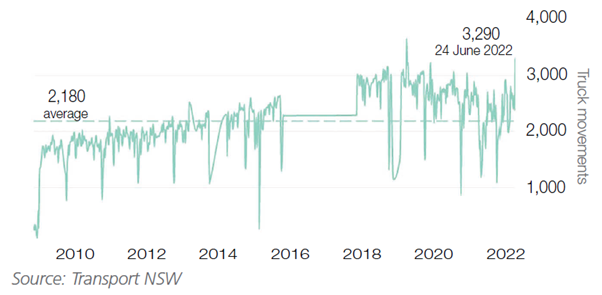

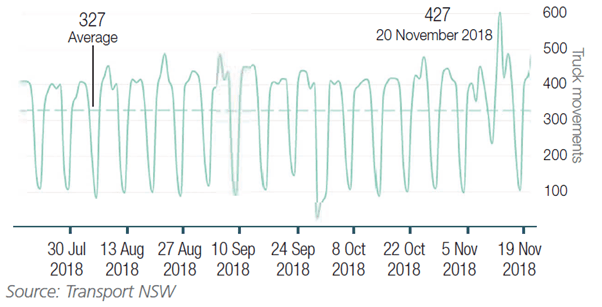

Fonteyn: It will shift from being an operational tool to also driving investment decisions. Data use in real estate investment decisions is going to play catch up to the other major investment markets, such as equities and bonds, which have been using big data and artificial intelligence to make sophisticated investment decisions. Increasingly, the use of AI, machine learning and big data can find correlations that predict where the market will go. Kooshan’s team has found, for example, that truck movements along the eastern seaboard of Australia are a strong predictive factor of rents and capital values rising or falling in industrial properties.

Fashami: Providing predictive analytics and predictive tools that drive investment decisions is going to become much more important in real estate. We expect a lot more data-to-decision tools and companies to emerge, with millions of data points that can be searched and analysed and visualised at speed to make informed decisions.

Is there such a thing as “too much data” in real estate?

Fonteyn: In commercial real estate around the world, we have the opposite problem. There is not enough data. In Australia, for example, there are voluminous amounts of information at multiple levels for residential real estate, but there are information “black holes” in terms of commercial real estate, specifically leasing. There is limited, reliable commercial information available about private “incentives” that are agreed between landlord and tenant. That’s surprising because Australia is one of the top ranked countries, globally, for transparency. There is virtually no information available in Singapore, New Zealand, Hong Kong — those markets are opaque.

What are the main barriers to accessing and/or interpreting data so that it can be applied to offer practical insights?

Fonteyn: The main barriers to accessing critical information are that it is either not public or it is so voluminous that it is not easily under- stood. To understand the market, you need access to commercial leases, incentives, sales turnout information in shopping centres and more. Once you have access to all these data sets, you also need a lot of sophistication. You need data scientists, technologists and real estate experts. This is where FLNT steps in, providing data users with the ability to search, subscribe, visualise and analyse data at speed.

How can recent advances in artificial intelligence or machine learning be leveraged to extract value in commercial real estate?

Fonteyn: The past several years delivered several advances in artificial intelligence. Imaging AI, or video scanning, is quite pervasive and is the most familiar application of AI. Lesser known is the natural language processing [NLP] form of AI. It uses a group of dialects to study language, to be able to read complicated documents and learn patterns to become almost like a human in terms of being able to analyse information out of complex contracts. In commercial real estate, a lot of information is trapped in contracts, which we call unstructured data. Unstructured data is normally not readable by machines, but the use of NLP allows the information to become structured and, therefore, machine readable. A product by FLNT, called Accurait, spearheads this advancement in Australia. Accurait uses a form of NLP called NeuroNER, which is an energy-recognition software that makes commercial leases digestible by machines for further analysis. Previously, a lot of that information was abstracted manually and put into a spreadsheet, requiring whole teams of people around the world to spend their days extracting information from contract documents.

Fashami: The recent advances in NLP would help the companies to process documents, contracts, invoices much more efficiently and allow the human resources to focus on more value-add tasks.

What will be the effect of data and technology on the way commercial real estate participants operate?

Fashami: More and more investors are asking their fund managers to provide evidence backed up by data on how they have made the investment recommendation. Currently, for a lot of companies, data is used after the fact to back up a commercial decision that has already been made. As we move forward, investors will require the fund managers to demonstrate how they have used a data- driven approach in the process of sourcing, analysing and making investment decisions.

Fonteyn: Real estate traditionally has been an illiquid investment, and investors would make their decision and then use historical data to support it. The problem is that the market and the world are becoming volatile. You need to have a predictive tool and be able to say, “We think the market is going here; therefore, we are making a forward-looking investment. We are using data to predict the market, rather than historically justifying why we made that decision.” A lot of the major REITs in Australia, particularly in retail, are beginning to use big data to inform their decisions around tenancy mix and operational requirements.

So, specifically, how can technology and data be utilised to make better investment decisions?

Fashami: Maybe you used to consider a specific property, applying your metrics only to that property. Of course, with any investment there are other factors in play — the market itself, the stakeholder, the global economy — but how can you assess all those risks within one investment decision? Technology and data can help assess the different levels of risk — What is the asset risk, what is the sector risk, or what is the whole market risk? The technology incorporates all of them into one formula to measure and visualise where the risk of that asset stands. And there will be a lot more factors to consider in the future — for example, environmental risk or climate risk, where data is becoming increasingly available.

Any final thoughts?

Fonteyn: I believe AI will have a seat at the table with the chief investment officer within the next decade. It may not have the final say, but the CIO certainly will have an AI algorithm recommending investment decisions. It is already happening in other industries. The technology is there, the data is catching up and the tools are available. In the next decade, there will be many changes in commercial real estate, including the traditional way real estate has been bought and sold. Take the smart contract, for example. That technology will profoundly affect all the people who touch the contract — the lawyer, the agent, the marketing professional. There are many new technologies, particularly in fintech, which are creating NFTs [nonfungible tokens] for residential and commercial real estate, and it requires transparency to create these models.