“EG has committed to ‘Real Zero’ carbon by 2030, taking a sophisticated, data-driven, approach to climate action. Read our Real Zero white paper here.

EG is proud to be targeting Real Zero carbon by 2030.

Real Zero carbon is different from ‘net zero’ carbon claims in that it doesn’t use carbon offsets or bulk Renewable Energy Certificate (REC) purchases to ‘net off’ total emissions at zero.

Rather, it uses sophisticated, real time carbon monitoring to reduce emissions via demand management, load shifting and 24/7 renewable energy purchases, in addition to energy efficiency, electrification and on-site solar and storage to reach Real Zero carbon by 2030.

So, what’s wrong with net zero?

Net zero targets are now ubiquitous in the property sector, with many groups already claiming net zero status.

The problem is that many of these targets are achieved through the bulk purchasing of carbon offsets and RECs. So, essentially writing a cheque whilst continuing to use fossil fuels to run buildings.

The issues with offsets are well known (a story for another blog) but even retrospective REC purchases are becoming an increasingly questionable way to ‘net off’ Scope 2 emissions at zero. Not every REC is created equally, with RECs generated in different states representing different levels of carbon abatement. For example, a REC generated in South Australia can be used to net off Scope 2 emissions in Victoria, where the electricity used is over three times as carbon intensive.

Further, users of RECs don’t need to know where the renewable energy they’re using was generated, what time of day it was generated (important as the carbon intensity of electricity changes as the sun rises and sets) and in what year it was generated. In fact, by the time a REC has been certified by the Government Regulator, purchased by a Property Group and finally retired to net off Scope 2 emissions at zero, it can be years after generation.

This carbon accounting is based on the Greenhouse Gas (GHG) Protocol’s Scope 2 Guidance. A document published in September 2015, which predates the Paris Agreement, the TCFD, and every single net zero target set by Australian REITs. Crucially, it also predates the technology which now – seven years later – allows us to monitor the real carbon intensity of the grid and tag renewable energy generated in 15-minute intervals. This allows energy users to match load with carbon-free energy, going 24/7 renewable on a live basis, rather than retrospectively matching RECs to load.

And it’s not just technology which has moved, societal expectations have evolved beyond offsets and bulk REC purchases, with greenwashing – a term that didn’t exist in 2015 – now a chief concern, locally and globally.

The other issue with using offsets and RECs is that they take an annualised approach to carbon. Purchasing offsets and RECs annually (or even monthly) limits your carbon datapoints (to one or at most, 12). This gives you an inaccurate understanding of your carbon footprint, denying the opportunity to use demand management to reduce carbon and assist the transition and decarbonisation of the energy grid.

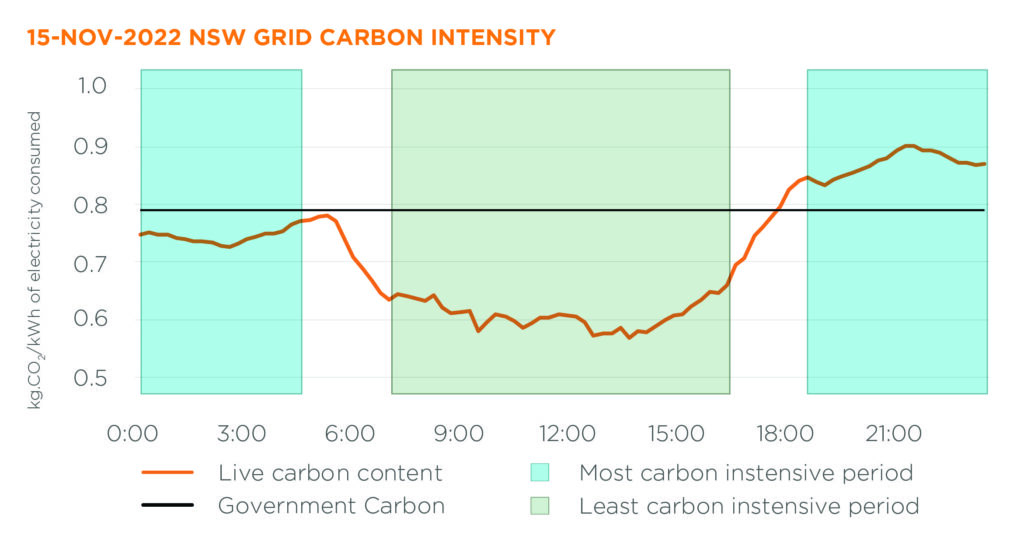

We should all be using the live carbon intensity of the grid (as freely available from open data source, opennem.org.au) to measure the carbon of the electricity our buildings use. Instead, we rely on the Government’s annually-released static NGA Factors which treat every kWh of electricity used as having the same carbon content over the course of a year. This is, of course, not the case. The carbon content of our electricity varies every 5 minutes. Check again, has it changed?

Live carbon data

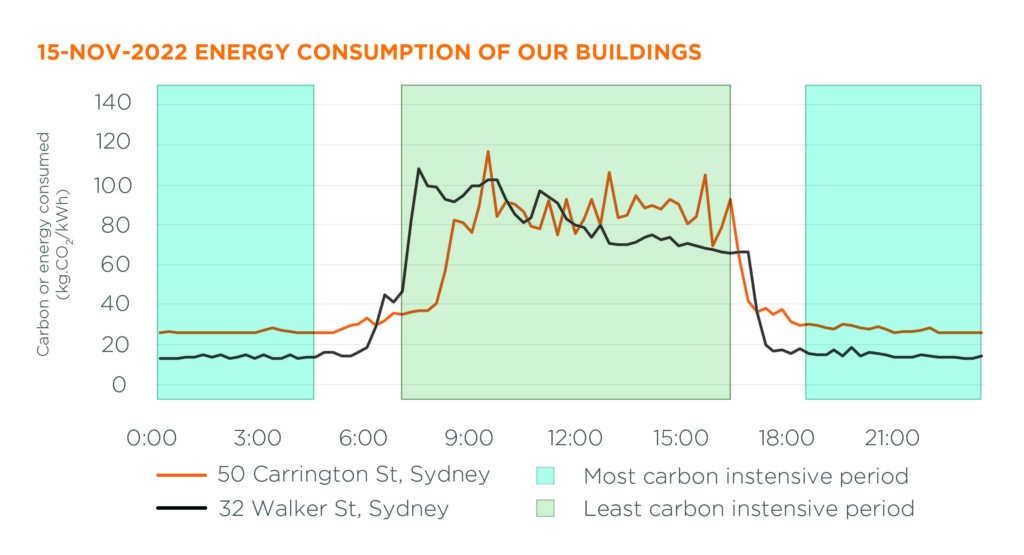

Using dynamic, live carbon data allows us to pursue Real Zero outcomes, because it distinguishes energy used at different times during the day.

Reducing building energy use when carbon content is highest (typically before sunrise and after sunset, given how much solar Australia has) and shifting it to time periods when carbon content is lowest (conveniently when our buildings tend to be occupied) is an easy and effective way to reduce carbon.

This is the key to the Real Zero approach.

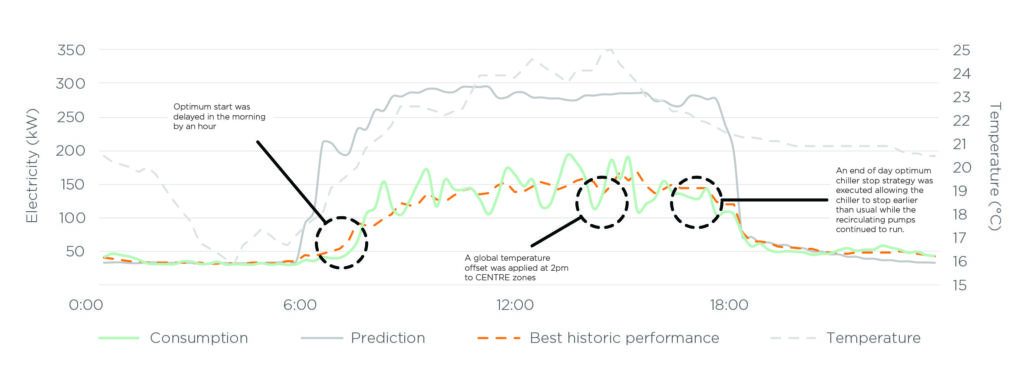

For example, consider our EG Delta Fund office building at 95 North Quay, Brisbane. The building’s systems and equipment (including heating and cooling) were turned on one hour later than they normally would be, the green line in the above. They then consumed more energy than they normally would ‘catching up’ to expected performance (scaling above the benchmarked orange line) and meeting the building’s cooling requirements. But, since this additional energy use occurred during daylight hours, with more, cheap, solar power in the grid, an overall carbon abatement of 4.6% was achieved. A great result.

Taking this approach – and, crucially, measuring carbon over a 24-hour period rather than annually – is key to unlocking these savings and reaching Real Zero carbon by 2030.

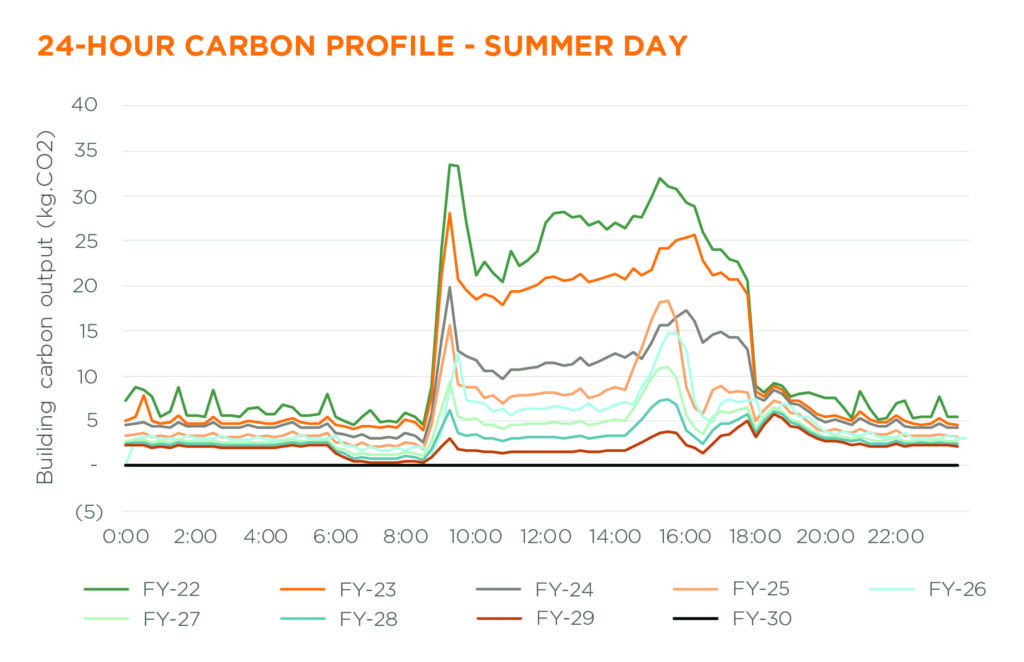

We hope it will look like this:

Is Real Zero carbon ambitious? Yes.

Will we get there? We can’t be certain.

But we’d rather innovate and assist the Australian energy grid decarbonise, allowing the demand side of the market to move in addition to the supply side, than write a cheque for offsets and RECs.

Australia’s energy grid must move from 33% renewable energy today to 82% by 2030 – one of the biggest challenges our Nation has ever faced. If Australia is to meet its Paris target and avert the worst impacts of climate change, this is a challenge we must meet. This is how we think we can help.

Real Zero. For real assets.